Michael Hartzell recently posted All 50 States to Pay Internet Sales Tax if Marketplace Fairness Act Passes, which got me thinking about the different proposed Internet Sales Tax bills currently under consideration by Congress.

Michael Hartzell recently posted All 50 States to Pay Internet Sales Tax if Marketplace Fairness Act Passes, which got me thinking about the different proposed Internet Sales Tax bills currently under consideration by Congress.

For those of you who haven't been following this closely, there are 3 proposed bills:

- The Main Street Fairness Act (MSFA) (S.1452, HR.2701)

- The Marketplace Equity Act (MEA) (HR.3179)

- The Marketplace Fairness Act (MFA) (S.1832)

Confused? You're not alone. Sylvia Dion's From Main Street to Marketplace Fairness Acts - Sales Tax 2011 provides some clarity to help you sort through the 3 of them.

The bils' underlying premise is that bricks and mortar "local" businesses would get a fairer deal if the Supreme Court's decision to uphold the U.S.'s current origin-based tax policy (sellers only collect sales tax from sales made in the states in which they have a physical presence) was overturned by a new law into a destination-based tax policy (sellers collect, report and pay sales tax based on where the product or service is used by the customer).

The 2 assumptions behind these proposed laws are 1) the belief that doing business over the Internet is "free" and "easy" and that 2) online sellers have a huge economic edge over local businesses' because they don't have to collect sales tax from remote buyers nor do they have the expense of a physical location.

Let's put to rest the myth that doing business on the Internet is free or easy.

It most certainly is neither (as those of us who own or serve Internet businesses can attest). It might be less expensive to get started than a bricks-and-mortar business, but neither do such businesses use up as many local resources either. As for "easy," the Internet is arguably the world's biggest marketplace and the most competitive.

Instead of competing against 16 similar stores in my local community, I'm now competing against millions (if not hundreds of millions) of such businesses on the Internet. Ask the average Internet-only business owner how many hours a week and how much money she devotes to competing for search engine page rankings and attention on the Internet. Easy? Walk a mile in my shoes!

The Pros and Cons of Different Business Models

In Hartzell's article above, you can watch Senator Jim DeMint (R-SC) tell the US Senate's Commerce, Science and Transportation Committee that there are hundreds of different business models from which to choose. And isn't that a wonderful thing!

He's right. Nobody holds a gun to my head saying if I want to sell widgets, I have to do it only in a mall, or a factory outlet, or from my home, or online or that I must sell at a certain price. It's my choice. But should any of these laws pass, that freedom could, over time, erode. (Read DeMint's OpEd piece, No Internet Taxation Without Representation for a very cogent statement of his position on the Marketplace Fairness Act.)

Sales Tax - A "Reward" ?

In 1872, Angus Montgomery Ward invented the direct mail order industry (a new business model) with his first mail order catalog. What enabled him to do that successfully? The creation of the US Postal Service and railroads that spanned the nation from coast to coast. What exploded that industry in the 20th century? A nationwide highway system with motorized vehicles called trucks and the invention of the airplane.

In fact, the direct mail order industry was becoming successful at the time of the great depression. Montgomery Ward and Sears were growing by leaps and bounds, providing employment both in their catalog pick up locations and for the creators of the products in their catalog.

And how did the politicians reward those businesses and the average consumer struggling to care for her family? By imposing the first sales taxes! People were told they were "temporary" and would never get above the .5% - 1%. And they innocently believed it.

Need I say more? We all know where sales tax rates are today.... However, fast forward...

Online Commerce - Innovative New Business Model

1979 brought us CompuServe's time-sharing network; Michael Aldrich invented online shopping. 1982 brought the Internet Protocol Suite (IPS). In 1984 Prodigy arrived on the scene. But it wasn't until Tim Berners-Lee invented a browser that made it easy to access the World Wide Web that a new business model could be born.

In 1995, when someone used a browser to buy a book from WH Smith's shop in CompuServe's first national online shopping mall -- the first online ecommerce business model came to life. Shortly thereafter Jeff Bezos and Amazon appeared, eBay, among many hundreds of other businesses. The rest of the story, you know.

The Internet has driven some of the most important commercial and economic innovations to date. And I would argue that imposing an Internet sales tax will stifle innovation in the US as never before. Especially given the intensifying rate of innovation around the world. Such a tax could very well crush our collective ability to experiment and grow—to try, fail, succeed and repeat.

If as a business owner I am forced to collect, report and pay sales tax for thousands of jurisdictions, I won't have time or money to do what's most important to the stability and growth of my business - create and deliver innovative products and/or services and acquire and serve customers. Those are what fuel the engine of economic growth.

To survive today, 48% of businesses have a website, regardless of which business model they use. Why? Because more than 70% of Americans research online before they buy.

Most physical businesses get about 30% of their revenue from online sales. Let's say (to be ultra conservative) those sales are spread across 10 states. Under these new proposed bills, that would be 10 different filings a business owner has to do every quarter. And since Internet sales tend to be at a lower price than in-person sales, the small business owner's margin grows ever slimmer if he doesn't pass along the costs of collecting and reporting that tax. Eventually he may have to decide whether he wants to give up the 30% of his business that's done online and figure out how he's going to make that up through local sales alone.

And even though software can automate much of the gathering and collecting of these taxes, filing accurate reports is still a time-consuming process. Not to mention the software to automate those tasks adds additional costs that most small businesses cannot afford.

How is this an improvement for small businesses? How will it help expand business, find more customers, reduce costs, create new products or services?

How does an Internet sales tax make the average small business' situation BETTER?

In the end, it seems to me that all 50 states and our country will lose, if any of these laws pass. Instead of leveling the playing field, it will do the exact opposite.

And it's not just small businesses who are affected. How do any of these bills help the average consumer or create new jobs?

Because any costs a business has for collecting, reporting and paying this tax must get passed on to the consumer as part of the seller's overhead. It also means the average small business owner, regardless of their business model, will probably make less profit and be unable to hire as many people. And in the end, because of higher costs turning into higher prices, these laws will make it even harder for consumers and businesses to thrive.

Just imagine. If we change to a destination-based tax policy, when you buy a product in a different tax jurisdiction (another city, county or state), you'll have to disclose where you will use the product or service you just bought so you can be charged the appropriate sales tax (typically your home or business address). This would apply NOT just to online sales, but to ANY sale. If you live in New York or Pennsylvania but drive to New Jersey to buy clothing to avoid paying sales tax, think again. You'll lose that tax break. And New Jersey and those sellers lose the revenue.

If you get no benefit by buying elsewhere, chances are you'll just buy locally. But what happens if what you want isn't available locally? To get it, you'll have to pay even more for it (shipping / handling / transportation) than you do today because sales tax would be based on destination, not origin.

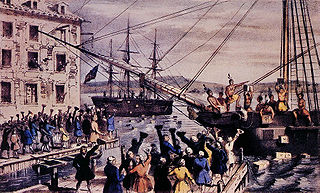

Bottom line: if tax policy shifts to a destination-based system, our consumer rights will be curtailed. Local governments will no longer need to compete for sales tax. Taxation without due representation, the very spark for our American Revolution, will be the norm.

Some of the top tax policy analysts in the country have stated that in the long-term we'll lose far more than we'll gain through the passage of any of these proposed laws because government powers grow, they rarely shrink. (Remember the first sales tax was supposed to be temporary...?)

In the end, you need to make up your mind for yourself. Here are some additional resources to get you started:

Daniel Mitchell, Senior Fellow, Cato Institute, on Tax Policy - Fairness: origin-based tax system versus destination-based tax system

Adam Thierer, Senior Research Fellow, Mercatus Center - Internet Taxation, Origins of Free Trade, Constitutional Implications

Streamlined Sales Tax Board - An organized collection of states that claim to be working to simplify sales taxes. Their philosophy is based on establishing a destination-based tax system (as opposed to the US's current tax policy of an origin-based tax system)

Marketplace Fairness Tax Pits Amazon vs. eBay - by Robert Wood, Forbes

National Governor's Association Statement on Marketplace Fairness Act

Be curious. Ask questions. Share what you understand. This is a pivotal moment in US history.

Should we be so foolish as to allow Congress to interfere in free trade and tax competition among the states, the economic constraints experienced by the districts of fictional Panem in the Hunger Games may become our reality sooner than we think. Do we really want to take a giant leap back 200+ years?

I for one don't relish having my freedoms curtailed in any way. Do you?